A Bitcoin ETF could change the industry for the better

It seems like only a matter of time before the SEC approves its first Bitcoin ETF. And once one ETF is approved, many more will likely be on their way. As a Bitcoin content marketer, it’s clear to me that this development could be huge for the public education, adoption, and exposure to the Bitcoin network. Here’s why.

The Bitcoin ETF market is huge

Some estimates put the total assets under management (AUM) for ETFs at $9.6 trillion. Bitcoin itself is only a $650 billion asset. Combine this with an estimated $14.4 billion of inflows from Bitcoin ETFs in the first year, and you have a recipe for major change. Consider that just on the rumors of an ETFs approval, the price of Bitcoin shot up by 10%. This was even before any ETF was approved. Once approval starts, the floodgates could open.

The public isn’t ready to self-custody

One of the main tenets of Bitcoin – the ability for individuals to self-custody assets without trusted third-parties – is essentially eliminated through the purchase of bitcoin via an ETF. This is surely going to rock the boat with Bitcoin purists who harken back to the words of Satoshi Nakamoto in the Bitcoin whitepaper:

“What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.”

An ETF, by nature, requires trust, which eliminates this Bitcoin principal altogether. But while bitcoin’s most ardent supporters are fighting against this type of third-party custody, the truth is, an ETF may be the best financial vehicle to introduce the currency to the wider public. ETFs from known, well-established financial firms like Fidelity, Van Eck, and BlackRock will make the average investor more comfortable investing into a Bitcoin product. And while

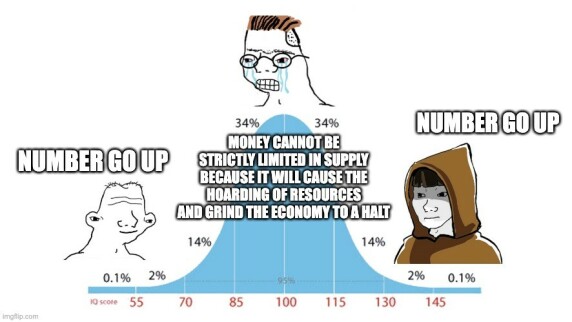

Most people still only care about number go up

As Bitcoin content marketers we have to be real: the majority of people are only purchasing Bitcoin because they believe it will grow in value over the coming decades. And even though “number go up” is a far cry from the reason bitcoin was conceived in the first place, it is the only real path toward the initial phase of mass adoption.

The average person isn’t going to purchase a Bitcoin ETF because they believe in a trustless, decentralized future. They’re going to invest because they want to make money for themselves.

ETF UX makes Bitcoin exposure easy

What’s great about an ETF is the user experience: to the individual, investing in an ETF feels identical to investing in a stock, something most people do these days from their computers or mobile devices. One of Bitcoin’s biggest roadblocks from a marketing perspective has been explaining self-custody and how to securely manage your own digital assets.

This is all abstracted away with the introduction of a Bitcoin ETF. Sure, individuals are now just entrusting their bitcoin to BlackRock and Fidelity. Sure, these investors won’t actually be holding Bitcoin, but outside of libertarians, anarcho-capitalists, and others on the edge, most people have no qualms making that tradeoff.

Even for those that fear impending doom within the global financial system (me halfway included), the Bitcoin ETF is a good first step in education.